Qualified Business Deduction 2024 – or from $364,200 to $464,200 (joint filers), there are some tests to determine whether you can claim the qualified business income deduction, and, if so, whether it’ll be reduced. In 2024 . One place you can start your advance tax planning is with the standard deduction amounts for 2024. Fortunately, the IRS has already released the standard deduction amounts for the 2024 tax year. The .

Qualified Business Deduction 2024

Source : www.taxpolicycenter.org

ODs on FB

Source : odsonfb.com

2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item

Source : www.tangiblevalues.com

ODs on FB

Source : odsonfb.com

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

Qualified Business Income Deduction (QBI): What It Is NerdWallet

Source : www.nerdwallet.com

Your First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com

National Society of Accountants (NSA) | Alexandria VA

Source : www.facebook.com

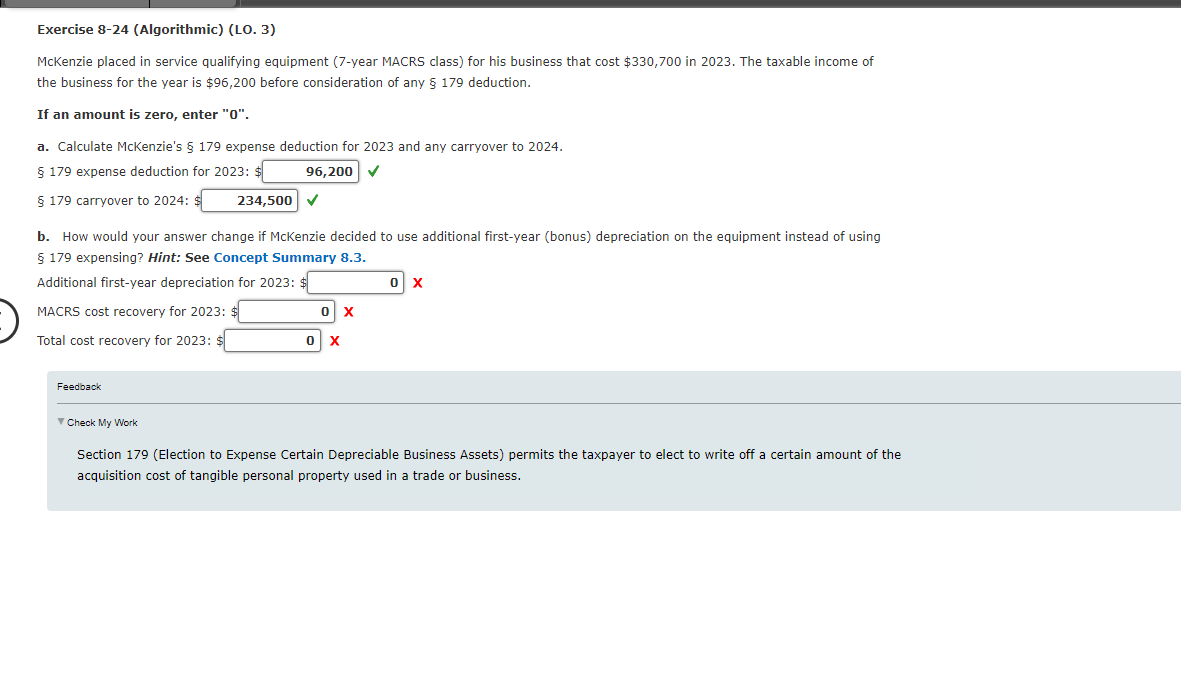

Solved Exercise 8 24 (Algorithmic) (LO. 3) McKenzie placed | Chegg.com

Source : www.chegg.com

2024 Important Tax Changes Brochure IMPRINTED (25/pack) Item

Source : www.tangiblevalues.com

Qualified Business Deduction 2024 T20 0221 Make Sec199A Deduction for Qualified Business Income : The 2023 standard deduction is $13,850 for a flat rate of $50 in 2024, credit score tracking, personalized recommendations, timely alerts, and more. Certain business, medical or moving mileage. . Here’s what all investors may want to know about the new IRS tax brackets for the next tax year. See how it will affect you.More From InvestorPlace ChatGPT IPO Could Shock the World, Make This Move .